6+ helene paid back $100 in month 1 of her loan

Initially a big proportion of the payments you make go into covering the interest rate which is quite high initially. In each month after that she paid back 50.

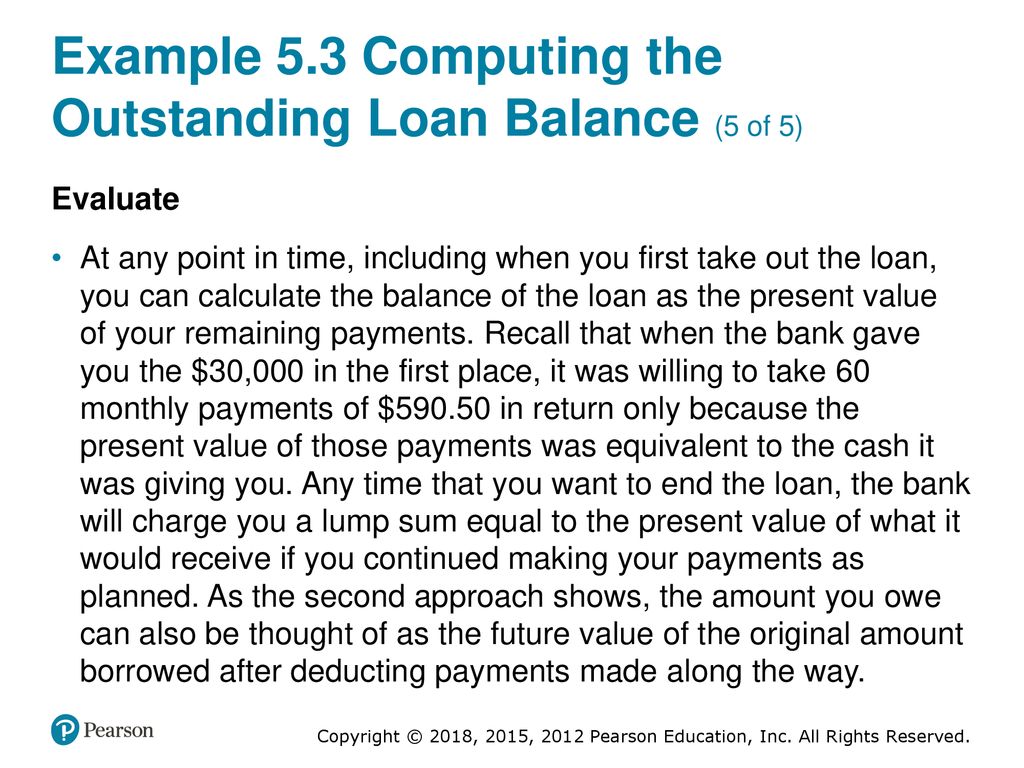

Fundamentals Of Corporate Finance Ppt Download

The octal number 46 expressed as a decimal number would be _____.

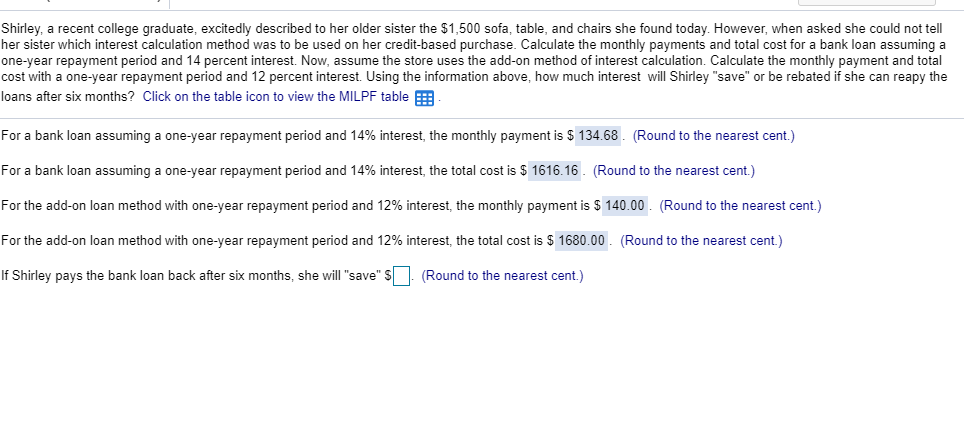

. In each month after that she paid back 50. Helene paid back 100 in Month 1 of her loan. For example 5 interest on a 50000 loan equals 20833 during the first month.

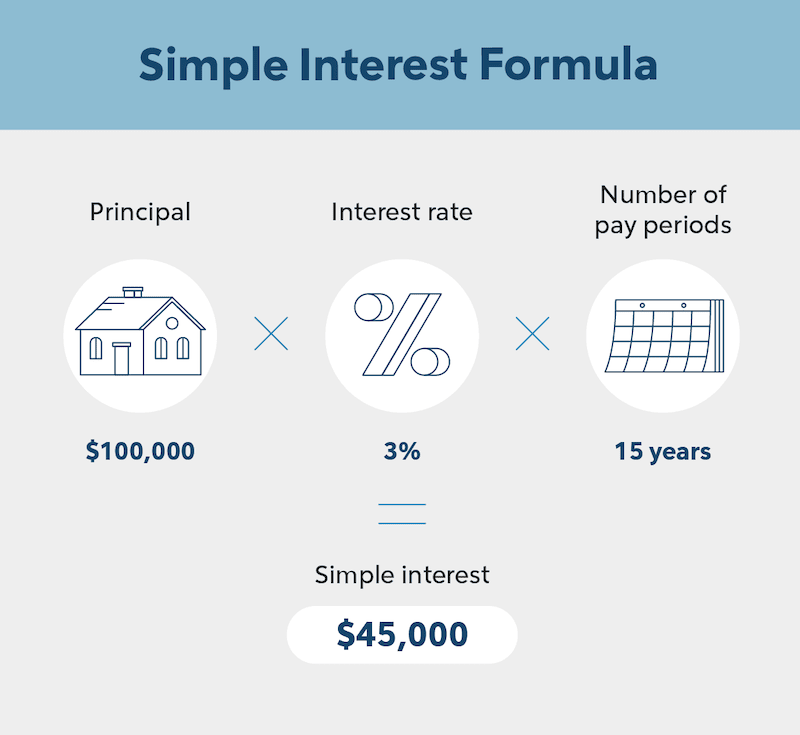

There are no 8s and 9s. Helene paid back 100. The loan is for 15 years.

Write an explicit formula and a recursive formula that shows fn the total. How much had she paid back on her loan in 1 year. Fn Step 4 - Simplify the explicit rule for the sequence.

For loan calculations we can use the formula for the Present Value of an Ordinary Annuity. The octal number system consists of digits 0123456 and 7. The personal loan calculator lets you estimate your monthly payments based on how much you want to borrow the interest rate how much time you have to pay it back your credit score and.

Face value denotes the amount received at. Loan Change Totals Current New Change Months 48. An online payday loan is appropriate for modest financial difficulties and is normally repaid over the course of 7 to 30 days.

But paying an extra. Your monthly payment would be 29588 meaning that your total interest comes to 1325840. The formula representing the total amount that Helen returned in month n will be.

PMT is the monthly payment. Write an explicit formula and a recursive formula that shows fn the total amount Helene had. Fn f1 dn-1 Substitute f1 and d to obtain.

In each month after that she paid back 50. Its hard to know exactly what her payment is without being familiar with the specifics of her loans but 100-200month is a reasonable estimate given that the average graduate owes. In comparison if a 100 savings account includes an APY of 1047 the interest.

Loan Repayment Calculator Answer. The graph shows the sequence. 4001 Loan Amount S.

When youre short on cash and need a little. Write an explicit rule. To calculate how much she paid on the loan for 1 year we first need to multiply the monthly.

In each month after that Helene paid back 50. 485 6 votes Lessen Your Loan Payoff For example you can save almost 900 in interest by paying an additional principal-only payment of 100 a month on a 60-month. 100 1 10 12 12 - 1 1047 Therefore the borrower will pay the lender 1047 in interest.

You borrow 40000 with an interest rate of 4. Up to 24 cash back Name _____ Date _____ Class _____ Constructing Arithmetic Sequences ASSIGNMENT. I is the interest.

Up to 24 cash back Helene paid back 100 in Month 1 of her loan. Arithmetic sequences have this general form. Loan shortened by 1 year 1 month savings 45566 in interest with new payments of 75000.

Helene paid back 100 in month 1 of her loan. Helene paid back 100 in Month 1 of her loan. P V P M T i 1 1 1 i n PV is the loan amount.

The face or par value of a bond is the amount paid by the issuer borrower when the bond matures assuming the borrower doesnt default.

Calameo Jcc Program Guide January 1 April 30 2014

Tuesday S Workwear Report High Waisted Pencil Skirt Corporette Com

Smithsfalls061115 By Metroland East Smiths Falls Record News Issuu

Monthly Installment Loan Tables 1 000 Loan Ith Chegg Com

What Is Simple Interest How To Calculate It For Your Home Loan Quicken Loans

/dotdash-INV-final-Ways-to-Be-Mortgage-Free-Faster-Apr-2021-01-43a0ae096f8542a081344ba976221702.jpg)

Ways To Be Mortgage Free Faster

Turbotax Class Action Saved From Forced Arbitration Top Class Actions

Tuesday S Workwear Report High Waisted Pencil Skirt Corporette Com

Platforms Archives Stl Partners

Kemptville050516 By Metroland East Kemptville Advance Issuu

Twitter Analytics Insights To Track Monthly Plus Tools Strategies Uniclix Blog

Platforms Archives Stl Partners

When You Are Finished Check The Solutions At The Back Of The Textbook Lesson 41 Course Hero

When You Are Finished Check The Solutions At The Back Of The Textbook Lesson 41 Course Hero

Wsj 2020 05 08 Pdf Wellness Medical

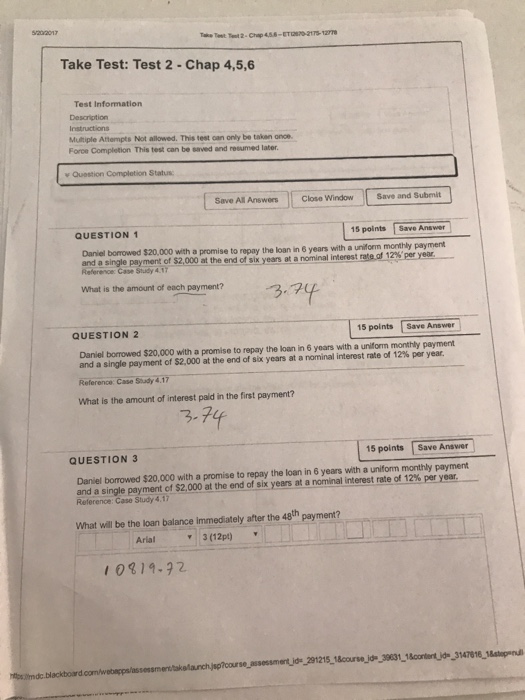

Solved Daniel Borrowed 20 000 With A Promise To Repay Loan Chegg Com

When You Are Finished Check The Solutions At The Back Of The Textbook Lesson 41 Course Hero