Payroll calculation online

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Payroll Formula Step By Step Calculation With Examples

3 Months Free Trial.

. Top Salary Calculator and Online Payroll Calculators in Market. Schedule a demo today. Local income tax will not be charged regardless of the Texas state youre living or working in.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. ADP online payroll services help you save time with these convenient features. Attract and retain todays top talent with HR payroll built for you loved by employees.

Starting as Low as 6Month. Small Business Low-Priced Payroll Service. Our online calculator will help you calculate the actual monthly taxable amount or provide you with the option to enter an estimated taxable amount for each fiscal year from July to May.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. It will confirm the deductions you include on your. Easy-to-use self-service app for.

Ad Combining HR-first tech with an experience employees love. It applies to anyone living or working in the state. Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions.

Ad From The Most Popular Payroll Services to Best for Small Business - Compare Costs Save. Your Texas Paycheck Tax. Intuit QuickBooks Paycheck Calculator.

Computes federal and state tax withholding for. Find Out Which One is Right for Your Business. Their name and the state where they live.

Ad Combining HR-first tech with an experience employees love. Easy HR Compliant Payroll And Support From Your Dedicated HR Manager. Free Unbiased Reviews Top Picks.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Ad Plus 3 Free Months of Payroll Processing. How to calculate annual income.

This includes just two items. How to calculate your paycheck. Employer Paid Payroll Tax Calculator With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start.

Fill in the employees details. For example if an employee earns 1500. Most employers use this paycheck calculator to calculate an employees wages for the current payroll period.

Ad Process Payroll Faster Easier With ADP Payroll. Form TD1-IN Determination of Exemption of an Indians Employment Income. Use this simple powerful tool whether your.

The payroll calculator from ADP is easy-to-use and FREE. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Ad Weve Listed the 10 Best Payroll Brands. Ad Compare This Years Top 5 Free Payroll Software. If you operate out of the USA QuickBooks salary calculator.

It only takes a few seconds to. Attract and retain todays top talent with HR payroll built for you loved by employees. Taxes Paid Filed - 100 Guarantee.

The net-pay calculator uses the latests PAYE NHIF NSSF values to calculate the net-pay and present it in a simple payslip as it could look in in a typical. Answer A Few Easy Questions We Will Match You With Our Top Payroll Service Providers. This will help the tool calculate some of.

Get Started With ADP Payroll. Ad Ensure Accurate and Compliant Employee Classification for Every Payroll. Reduced risk of manual errors with automated online payroll processing.

For employees who receive wagessalary of RM5000 and below the portion of employees contribution is 11 of their monthly salary while the employer contributes 13. It is perfect for small business especially those new to payroll processing. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator. Manange Your Payroll Online With These Easy Affordable Choices. Schedule a demo today.

If this describes your situation type in your employees gross pay.

Paycheck Calculator Take Home Pay Calculator

Payroll Calculator Free Employee Payroll Template For Excel

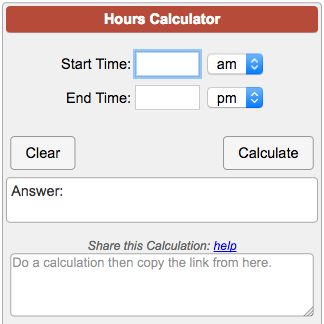

Hours Calculator

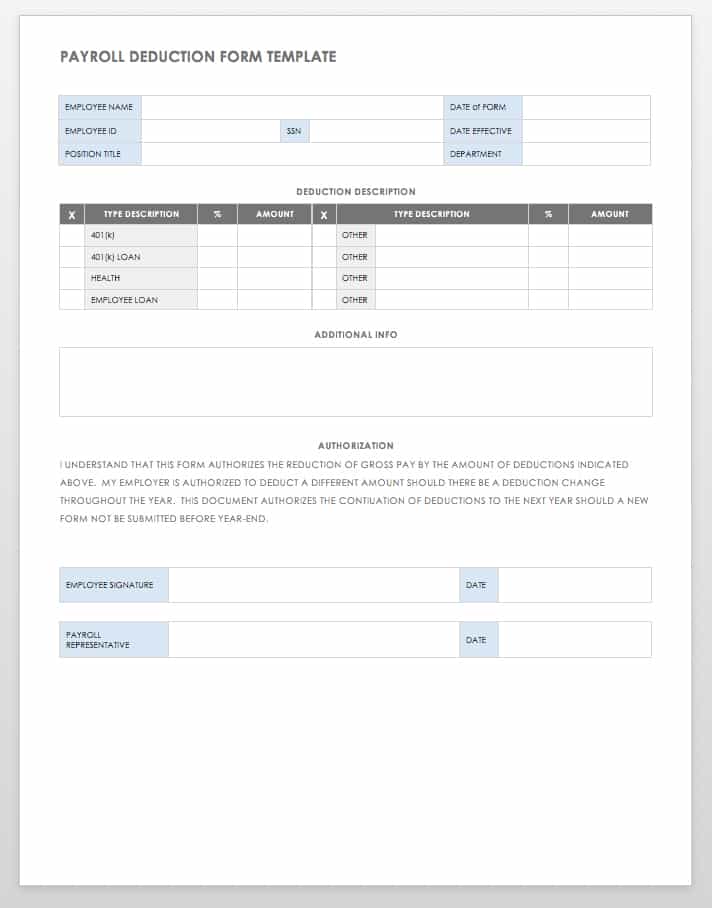

15 Free Payroll Templates Smartsheet

Payroll Formula Step By Step Calculation With Examples

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

15 Free Payroll Templates Smartsheet

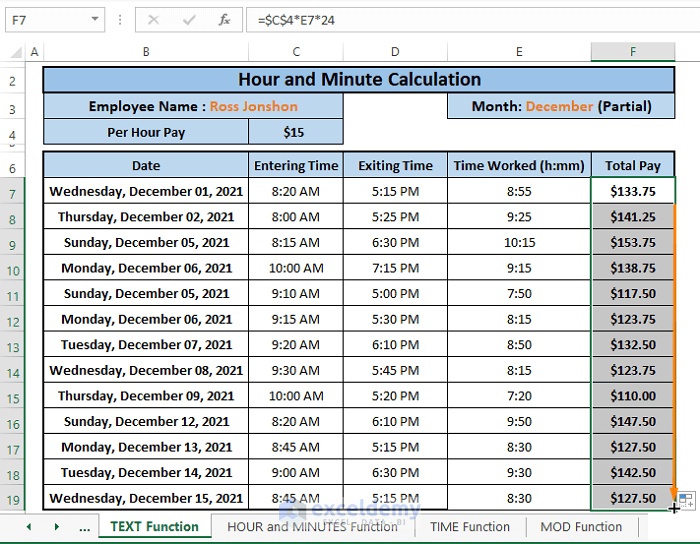

How To Calculate Hours And Minutes For Payroll Excel 7 Easy Ways

Ms Excel Printable Payroll Calculator Template Excel Templates Payroll Template Excel Templates Sample Resume

Paycheck Calculator Take Home Pay Calculator

Salary Increase Template Excel Compensation Metrics Calculations Salary Increase Business Budget Template Excel Budget Template

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator